How to Make Money Starting with Nothing

If you typed “How to make money starting with nothing” into your search engine or clicked on a social link from Twitter and landed here, welcome! I’m happy to have you. You’re part of a special group of have-nots looking to bootstrap themselves into generational wealth.

Here’s a quick overview of what we are going to cover:

Step 1: Cultivate the self-belief that you can build wealth.

Step 2: Find your path to riches.

Step 3: Own equity.

But first, This is not your normal “How To Make a Buck” article…

This series is going to be a little bit different than the others you’ve read.

Most of the articles on “how to make money starting with nothing” list ways to earn money. Lists like this one from Pop Sugar that encourages you to write a blog, create an app, create YouTube videos, etc.

This isn’t bad advice in and of itself, but if you’re looking at that list and haven’t done any of those things already, it’s not likely to spur you into action.

This series of articles is going to talk about foundational principles of wealth creation, and the mindset you need to walk the path.

I’m not a “guru,” and I’m not rich. I wasn’t born into money and I get out of bed every morning at 6 a.m. to write for this blog before I put in a day’s work. I don’t have any courses to sell you or e-books to shill you.

What I do have is a beginner’s mindset. And I think that’s important when you’re trying to learn how to build wealth.

The issue with most of the advice out there on wealth creation is that people are selling you what made them rich, not what’s going to make you rich. Naval Ravikant says it best in his blog, How To Get Rich (if you haven’t listened to the podcast yet, stop reading this and go do it now). Naval writes:

If you ask a specific person what worked for them very often it’s just like they’re reading out the exact set of things [that] worked for them which might not be applicable for you. They’re just reading you out their winning lottery ticket numbers…There is something to be learned from them. But you can’t just take their exact circumstance and map it onto yours. The best founders I know, they listen [to] and read everyone. But then they ignore everybody. And they make up their own mind.

What’s going to make you wealthy (if you want it badly enough) is entirely unique to you. The difference-maker isn’t going to be some e-course that you buy about real estate flipping. It’s going to be a combination of your passion, skill set, network, and circumstance.

What I want to focus on are the principles of wealth creation. And those are adaptable to your circumstance.

How much money do you need to be wealthy?

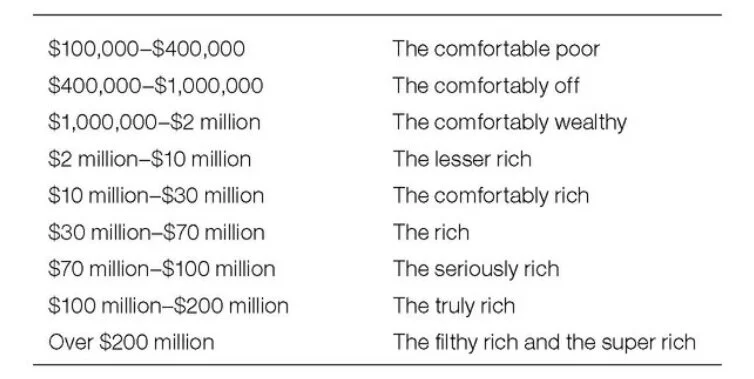

First, how much money do you need to be “wealthy”? We could use Felix Dennis’ definition of rich from his book, How To Get Rich:

So, about $30 million-$70 million USD would do the trick. A few million in the bank when we “retire” at 65 is not the goal here. Freedom is the goal.

You don’t actually need that much for freedom though. If your goal is to quit your day job and start working & living for yourself, you just need enough passive cashflow (from businesses or investments) to pay all your expenses each month. And that number is (mostly) up to you.

One other note before we get into how to make money starting with nothing. The journey of creating generational wealth will be easier if you are rich in other ways: in love, health, and support.

I am fortunate to have a wife that loves me unconditionally, and a family that supports me always. I am healthy in both body and mind. These will help in a very specific way: stamina. It will take years and years to get rich, and you’ll need your energy.

Ok, let’s get to it. Here’s the first step in how to make money starting with nothing:

Step 1: Cultivate the self-belief that you can build wealth.

It sounds hokey but it’s critical to build this belief system. Most people who start with nothing want to be wealthy. But many of them don’t take the time to cultivate the belief that they can actually do it.

This cognitive dissonance (wanting something you believe you can’t have) is usually resolved by that person changing the want. They convince themselves that wealth isn’t something to be desired in the first place. This warps their view of money (and those who have it) in the process. Suddenly, the accumulation of wealth is something to be scorned, not celebrated.

I grappled with this dissonance myself. I’ve thought about it at length. I’ve written about it. I’ve talked about it with friends and family members. You can read my article on how I’ve adjusted my point of view to see wealth accumulation as the pursuit of freedom. Sharing my thoughts publicly has helped me get very specific about why I’m on this journey.

There’s another advantage to sharing your thoughts and desire for wealth (no matter the reason) with others. Any time you make a public commitment, you leverage commitment and consistency tendency. This is the tendency to act in accordance with a commitment you’ve made. It has helped me stay on track during the times I question what I’m doing and why I’m doing it.

Naval Ravikant talks about leveraging this bias before he started his first company. When he was an employee, he would go around the office telling everyone who would listen that one day he was going to leave to start his own business. After some months past, co-workers kept asking him why he was still there. This spurred Naval to leave and actually do it. When you make a public commitment and others know about it, it’s much easier to stick to it.

To learn a few other ways you can leverage your own mental biases, read my article on: 5 Ways to Hack Your Own Psychology to Be More Productive.

If you need some help getting specific about why you want to be wealthy, take 10 minutes and write out answers to these 5 questions below. I did this when I started Wealest, and I revisit/update my answers every quarter.

Question 1: What does it mean to you to be wealthy?

This is important because your answer to this question is going to frame your entire journey. It could be a dollar figure, or a lifestyle (like working from home), or working a job you love. There’s no right or wrong answer, just make sure that when you think about “wealth” creation, you know exactly what that means.

Question 2: Why do you want to pursue it?

What’s your incentive? What’s the driving force behind your need to create wealth? Is it freedom of time? Freedom from work? Is it a certain lifestyle you’re looking to create? Defining why you’re on this journey will keep you going on days you don’t feel like pushing forward.

Question 3: What do you want your life to look like?

Picture your perfect day. Try to visualize it clearly. What’s the first thing you do after you wake up? Do you exercise? Meditate? Sip a cup of coffee? Take the dog out for a walk? Let your mind wander and write out your perfect 24 hours (including how much sleep you get). This is what you’ll be trying to create on this journey.

Question 4: What’s holding you back from pursuing the life you want?

This question is all about inverting the problem. What’s holding you back from starting on your path to wealth creation? What are you most afraid of? Define your fears in vivid detail so they are no longer an abstraction. Once they are clear in your mind, ask yourself how likely it is that these worst-case scenarios come to pass.

Question 5: What’s the timeline for reaching your goals?

I prefer to plan in 1, 3, 5, and 10-year chunks. This gives me near term objectives that are building towards the larger, 10-year goal. Keep these timelines in the back of your mind as you go to work each day.

If you wrote out your answer to each of these questions, congratulate yourself. Most people who say they want to be rich won’t do the work to get there. This is a meaningful start. It may not feel like you’re any closer, but you are.

Cultivating the self-belief that you can create wealth doesn’t happen quickly. I’ve been on this path for about 3 years now, and it’s still fragile. But it’s important to do because you are going to face many obstacles and detractors. People who say it’s not possible. That it’s a waste of time. That it’s morally reprehensible. This is when you’ll need a rock-solid belief system.

So be patient with yourself. Keep learning and digging. Once you’ve put a specific intention into the world, you’re setting up your subconscious to look for opportunities that will get you closer to your goal.

Ok, so you’ve cultivated a self-confidence in your pursuit of wealth. You believe in your heart of hearts that it’s possible to create generational wealth from nothing and that you can do it.

You are ready to move onto the second phase of how to make money starting with nothing.

Step 2: find your path to riches.

Your goal is to find something that you like to do, that you are naturally good at, that you can make money doing.

Writer Scott Galloway has a simple illustration to help find this sweet spot:

Let’s go through this circle by circle.

Finding Things That Don’t Suck

It’s hard to find something you love to do, but easy to know what you hate. That’s why Galloway’s illustration lists “things that don’t suck” instead of “things you love.”

Start there. Try a lot of stuff, keep a list of things you HATE to do, and then steer clear of any job or education path that involves those things.

When I was 16, I worked for a landscaping company for a couple of years in my small Canadian town. I learned two things from shoveling, planting, digging, and sweating 3 months under a blazing hot sun:

1) I hate when my hands are dirty.

2) I hate physical labor.

These two insights may seem arbitrary, but they had an impact on the direction of my life. I chose to steer clear of landscaping, but I also naturally moved away from architecture, engineering, geology, and the like.

What it pushed me towards was a career of ideas. And that has made all the difference - my hands haven’t been dirty since those summer days of high school. So, keep a list of things you hate to do. It’s more valuable than you think.

Finding Things You Might Be Good At

This is tougher than finding things you hate to do, but there are ways to know if you are on the right track.

For the lucky few, you may find out early on that you have an incredible talent for something - maybe it’s a sport, or playing an instrument, or singing.

My wife, for example, is a working actor. It’s the only thing she has ever wanted to do, and after booking a lead role on a kid’s show at the age of 18, it was also clear she had a talent for it.

It’s not so easy for the rest of us. I sometimes envy her obvious path because I’ve never been so clear of my own. I’m sure some of you feel the same. Don’t get confused – her path is incredibly difficult, but it’s clear to her. You and I have to pay a little more attention to what we’re good at!

In an interview with Tim Ferriss on The Tim Ferris Show, writer Adam Grant talks about a technique that can help you find out what your hidden skills are. The goal of this exercise is to find your “bright spots” - the things you’re good at but can’t see (like “blind spots,” but positive.)

Here’s what to do:

Send out an email to 20 people (friends, co-workers, etc.) asking them to tell you a story about a time when you were at your best.

Read all the stories and identify the themes in each one.

Group the common themes to get a sense of what you’re good at.

When Grant did this exercise, he found a common theme telling him that he was at his best when he was helping other people be at their best. He vowed to somehow integrate this into his career, not just because his community was telling him this was a skill, but because he liked helping people too. That’s hitting 2 out of the 3 circles in the Venn diagram. Grant became a writer and professor helping others to achieve their potential.

I ask my wife about once a quarter what she thinks I’m good at. This not only feels nice when I hear the answer (it’s a great boost, trust me), but it also reminds me to play to my strengths.

Try Grant’s exercise for yourself to identify your own “bright spots.”

Finding Things People Will Pay You To Do

The previous two circles have you looking within yourself. This circle has you looking out at the world. Notice that this question is not about what industry you can make the most money in. It’s only about what other people are willing to pay you to do. It’s about solving someone’s problem for them – no matter what that problem is.

There are people out there making money in ways you don’t know exist. That’s one of the things you learn once you finish a degree. In college or university, you are only exposed to conventional jobs within your field. But the real world is messy. There are many ways to make money – you just have to dig for them.

In most cases, there is someone out there who has found great success selling or doing the thing you want to do. Go and find that person (Twitter is great for this) and find out as much as you can about their day-to-day activities.

Who are their customers? What are they selling? What are their prices? If you can identify a problem that needs solving, there’s a good chance someone is already working (and selling) the solution.

Once you get into this mindset of identifying problems to solve (and the opportunities they create), you’ll never go back. I see opportunities everywhere. Execution is the key, but an opportunity is the beginning.

As Galloway’s Venn diagram suggests, you want to be in the field where these three circles overlap: where you like what you do, you’re good at it, and someone will pay you to do it.

If your job is hard for you, you’re doing the wrong thing.

Sure, you could slug it out, but why? There’s someone else out there who this particular line of work comes easy for. Over the long run, that person is going to beat you to a pulp at this particular game. If it’s hard for you, let it go and keep looking.

Now, this doesn’t mean you should just give up if something is too hard. Knowing that you have an inclination for something and digging to get better at it is different than banging your head against the wall in a field you don’t enjoy and don’t understand. You have to know the difference.

Find Something You Can Scale.

If you want to make money starting with nothing, you want to work in a scalable industry. Nassim Nicholas Taleb, in his book, The Black Swan: The Impact of the Highly Improbable (Incerto), tells us that a scalable profession is one “in which you are not paid by the hour and thus subject to the limitations of the amount of your labor.”

Think about it like this – does the amount of work you put in determine the amount of money you can make? If you are on an hourly wage as an employee, then this is a direct correlation and the answer is yes.

But imagine that you make a YouTube video every week. Media like this is scalable – it’s free to duplicate over and over at no additional cost. Let’s say it takes you about 5 hours to make that video. Once it’s live, the potential upside of that 5-hour investment is much greater than an hourly wage. Every person with an internet connection can watch your video without any extra effort from you, and you can sit there and get paid with advertising. That’s a scalable investment that’s asymmetric - the upside is much greater than the downside.

Here’s how Taleb puts it in his book:

Other professions allow you to add zeroes to your output (and your income), if you do well, at little or no extra effort…If you are an idea person, you do not have to work hard, only think intensely. You do the same work whether you produce a hundred units or a thousand.

Here are some scalable activities you could start pursuing:

Blogging

Investing

Writing Digital Books

Creating Digital Products (How-To Guides, Educational Courses, etc.)

Shooting Videos (for YouTube, Instagram, TikTok, etc.)

Coding

Software development

Start looking at the world through the eyes of scalability.

Can you scale the sandwich you bought for lunch? No, the chef has to make a sandwich for each new customer.

Can you scale the email you just sent? Yes, absolutely – and people do with email newsletter lists they’ve built out into the millions.

Keep in mind though that scalable industries are often “feast or famine” industries. This means that the majority of the money goes to a few big winners. Taleb has this warning for us:

[They are] only good if you are successful…they are more competitive…and far more random, with huge disparities between efforts and rewards— a few can take a large share of the pie, leaving others out entirely at no fault of their own.

But we are here to make money starting with nothing. Ignore this warning and start anyway.

Find A New or Emerging Field.

It’s easier to get rich in an emerging field – something right out on the edge of technology. Felix Dennis, who made his fortune in publishing, has this to say about your search for wealth in his book, How To Get Rich:

New or rapidly developing industries, whether glamorous or not, very often provide more opportunities to get rich than established sectors. The three reasons for this are availability of risk capital, ignorance and the power of a rising tide.

If you can become an instant “expert” in a new industry, this can be a ticket to capital.

Dennis grew up playing pinball and electronic arcade games. When the “personal computer” arrived in the 1980s, he had a feeling that it was going to be a big deal, despite many other magazine retailers stating that “nobody will ever buy them.”

When the rest of the industry was leaning out, Dennis leaned into this new wave. He knew nothing about computers himself, except that there was a group of passionate “nerds” and science journalists who believed the industry would grow. So, he launched a slew of magazines on the subject, while earning the respect of the industry with his team’s “expert” knowledge. This wave provided his company with capital to expand – it was the new market at work, and that market grew larger and faster than anyone could have imagined.

According to Dennis, you should be looking for:

Growing industries with relatively low start-up costs

And avoiding:

Declining industries

Industries that need huge start-up investment

Bitcoin was the greatest performing asset of the 2010s decade. One dollar invested in Bitcoin at the start of the decade would have turned into about $90,000. How many people do you think got rich by being at the forefront of this technology early on?

This isn’t advice to go buy speculative, volatile assets (you can lose all your money in cryptocurrencies), but these are the kinds of opportunities to be looking for. And if you can do the research and become an “expert” before anyone else, you have the advantage to leverage that as the industry grows.

Step 3: Own equity.

If you are going to get rich, you need to own equity. Equity is just a fancy word for owning a piece of a business.

There are a few different kinds of equity. You could own a business that you started, or you could own a piece of a larger business, like a stock, that you buy on the open market. You could also own a piece of a start-up company that you invest in privately in exchange for shares. Or maybe you own a piece of a product or a piece of intellectual property (IP) like a book, script, or other artwork.

No matter what kind of equity it is, remember this: equity is everything. Try to get as much of it as you can.

The late Felix Dennis writes:

Please think about this if you want to be rich. Ownership is not the most important thing. It is the only thing that counts.

Equity gives you unlimited upside.

Owning a piece of a business means that there’s no cap on your upside.

When you work in a salaried position, your upside is limited to a yearly salary or an hourly rate. Sure, you may get a nice bonus at the end of the year, but ultimately your upside is capped because the input (the hours you put it) is matched to the output (your hourly wage). There’s no additional upside potential.

If you are going to get rich, you need unlimited upside.

Equity gives you that.

A stock (a piece of a business) like Apple or Amazon or Google has no capped upside. The price and value can continue to rise with the growth and profitability of the business. The business (and stock price) is capable of growing at 5% per year or 100% per year.

If you run your own company, you get to keep what’s left after you pay out your expenses. There’s no hourly wage or yearly salary to cap your earning power. You have unlimited upside potential.

12. You have to dig for your financial freedom.

— Thomas (@TWaschenfelder) October 31, 2019

There’s no financial literacy in this country. Once you learn the power of compound interest, you will focus on little else. It’s that powerful.

12/20

Equity disconnects inputs from outputs.

Angel investor, Naval Ravikant, explains that equity decouples your inputs from your outputs.

For example, you could spend 1,000 hours researching one stock to buy and then make nothing on your investment. Or, you could spend 5 hours researching a stock and make 100% on your investment in a year.

Your results have little to do with the hours you put in. All of your gains could occur while you’re asleep. When you own equity, the inputs and outputs are decoupled.

In my business, I write treatments (creative proposals) to pitch to clients. The amount of time I spend on the proposal (input) is not coupled to the output. I could spend 10-minutes on a simple, one-page proposal and it could lead to a deal worth hundreds of thousands of dollars, or I could spend 10-hours building a PowerPoint presentation that leads to nothing.

My wife is an actor and these same rules apply to her career. She could spend 10,000 hours in acting classes working on her craft (and she probably has) and come up with nothing. Or, she could send in one self-tape audition that took 30-minutes to record and it changes her life.

It’s not a coincidence that both my wife’s career and mine function like this. We both work in the arts, and Ravikant points out that creative professions tend to have inputs that are disconnected from outputs.

Think about your career. What are the parts of your industry where the inputs are disconnected from the outputs?

Equity means you can’t be replaced.

Ravikant tells us that when you own equity, it’s a lot harder to be replaced by someone else compared to a salaried position.

A job with an hourly wage precisely matches the input with the output. You are doing the same task, or the same set of tasks repeatedly. Someone else can be taught to do the job, just like you were taught to do it.

But with equity, you are an owner. You share in the brand, product, business plan, or IP in exchange for risk and accountability. You are not renting out your time. Instead, you are sharing in the upside (and downside) of the business you help bring into existence. This makes it harder for you to be replaced.

Equity means you own the risk.

With great upside potential comes great downside risk.

Ravikant reminds us that if you are an owner, you get paid after everyone else. That’s great if the business is profitable. But if there’s nothing left of the pie by the time you’ve paid all your expenses, debts, and employees - too bad. You get nothing.

There’s no ownership without risk.

But it’s worth it in the end because:

Equity buys you freedom of your time.

Time is everything. It’s your most important non-renewable resource. Once it’s gone, it is gone for good.

You can always make more money, but you can’t get back your time.

I recently saw Charlie Munger speak in person. It was one of the highlights of my life. He is 96-years-old, incredibly lucid, and extremely rich.

If he could switch lives with me this instant, do you think he’d do it?

Of course, he would. He can buy anything he wants on earth, but it’s time he can’t get back.

Equity buys you freedom of your time.

When you own equity, it doesn’t matter how many hours you put it. What matters is how much someone is willing to pay for the thing you’ve created. You can make money while you sleep, sit on the beach, meditate, or work out.

The late millionaire Felix Dennis writes in his book, How To Get Rich, about what money meant to his life. This excerpt strikes me:

And just what is the most precious thing in life that riches can supply? Easy. For me, it’s Time.

Time. Time to read and write poetry if I want to. Or to write a book if it takes my fancy. Time to travel on the slightest whim, to walk in the woods, to think, to commission art, to read, to drink, to hang out with friends and loved ones...to do just about anything really…

That’s what money can do.

We are all pursuing the same thing. Build wealth to buy freedom.

Start now and good luck.

If You Want More Ideas Like This, Follow Me On Twitter And Subscribe To My Newsletter:

Legal Disclaimer

The content contained in this blog represents only the opinions of the author. The content herein is intended solely for the entertainment of the reader and the author and should not be relied upon in making any decisions.

—

Here’s Naval’s How To Get Rich podcast + transcript: https://nav.al/how-to-get-rich

Dennis, Felix. How to Get Rich: One of the World's Greatest Entrepreneurs Shares His Secrets. Penguin Publishing Group. Kindle Edition.

Taleb, Nassim Nicholas. The Black Swan: Second Edition: The Impact of the Highly Improbable (Incerto). Random House Publishing Group. Kindle Edition.